Forex trading, also known as foreign exchange Forex Trading Contests, has emerged as a popular investment avenue for individuals seeking opportunities in the global financial markets. This decentralized market facilitates the buying and selling of currencies, allowing traders to speculate on currency price movements. Understanding the fundamentals and employing effective strategies are crucial for success in the dynamic world of Forex trading.

Understanding Forex Trading: Forex trading involves the exchange of currencies, where traders aim to profit from fluctuations in currency values. The market operates 24 hours a day, five days a week, across different time zones, making it highly liquid and accessible to traders worldwide. Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY are frequently trade, although numerous other pairs are available for trading.

Key Elements of Forex Trading:

- Currency Pairs: In Forex trading, currencies are trade in pairs. The first currency in the pair is the base currency, while the second is the quote currency. For instance, in the pair EUR/USD, the euro is the base currency, and the U.S. dollar is the quote currency.

- Leverage: Forex trading often involves the use of leverage, allowing traders to control larger positions with a smaller amount of capital. While leverage amplifies potential profits, it also magnifies potential losses, making risk management crucial.

- Market Analysis: Traders use two primary methods for market analysis: technical analysis and fundamental analysis. Technical analysis involves studying historical price data and patterns to predict future price movements, whereas fundamental analysis considers economic indicators, geopolitical events, and news to gauge currency value.

Effective Strategies for Forex Trading:

- Develop a Trading Plan: Establish clear goals, risk tolerance, and a strategy for entering and exiting trades. A well-defined plan helps manage emotions and stay disciplined during trading.

- Risk Management: Implement risk management techniques, such as setting stop-loss orders to limit potential losses. Risk should be carefully manag to protect trading capital.

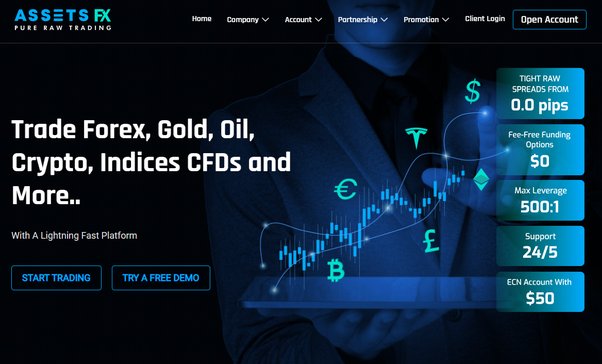

- Practice with Demo Accounts: Utilize demo accounts offered by brokers to practice Forex Trading Contests strategies and familiarize yourself with the platform without risking real money.

- Continuous Learning: Stay updated with market trends, strategies, and economic news. Continuous learning is vital for adapting to changing market conditions.

Conclusion: Forex trading offers ample opportunities for profit, but it requires dedication, knowledge, and discipline. Understanding the market dynamics, employing effective strategies, and managing risks are fundamental to success in Forex trading. Beginners should start with adequate education, practice in demo accounts, and gradually transition to live Forex Trading Contests with a well-defined plan. Remember, success in Forex trading comes with experience and continuous learning.